Delhivery is proving to be one of the rare listed startups to have its profitability and growth marching in lockstep.

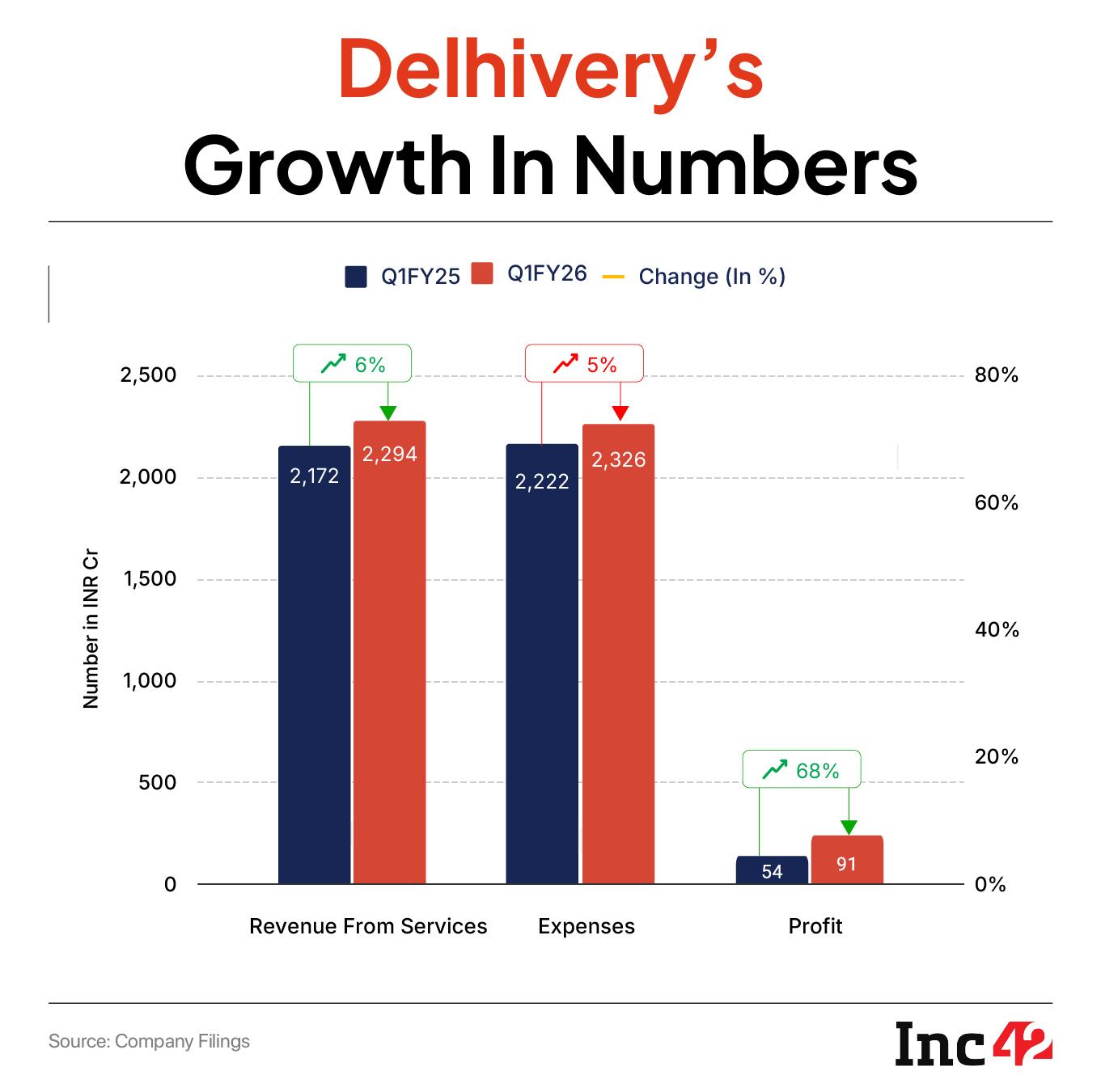

After closing FY25 staying in profit through every quarter, the Gurugram-based logistics major has kicked off FY26 with its highest-ever quarterly profit. In the first quarter of this fiscal, its revenue scaled INR 2,294 Cr, while net profit surged nearly 68% on-year to INR 91.1 Cr, striking a fine balance between expansion and operational efficiency.

The performance matched steps with its boldest bet ever that sent the stock soaring. Delhivery acquired rival Ecom Express in an INR 1,369 Cr deal in July. On August 4, the Delhivery shares jumped 5.32% to hit a fresh 52-week high of INR 452.75, leaving brokerages more bullish on the back of volume-led growth, improving margins, and an upbeat outlook.

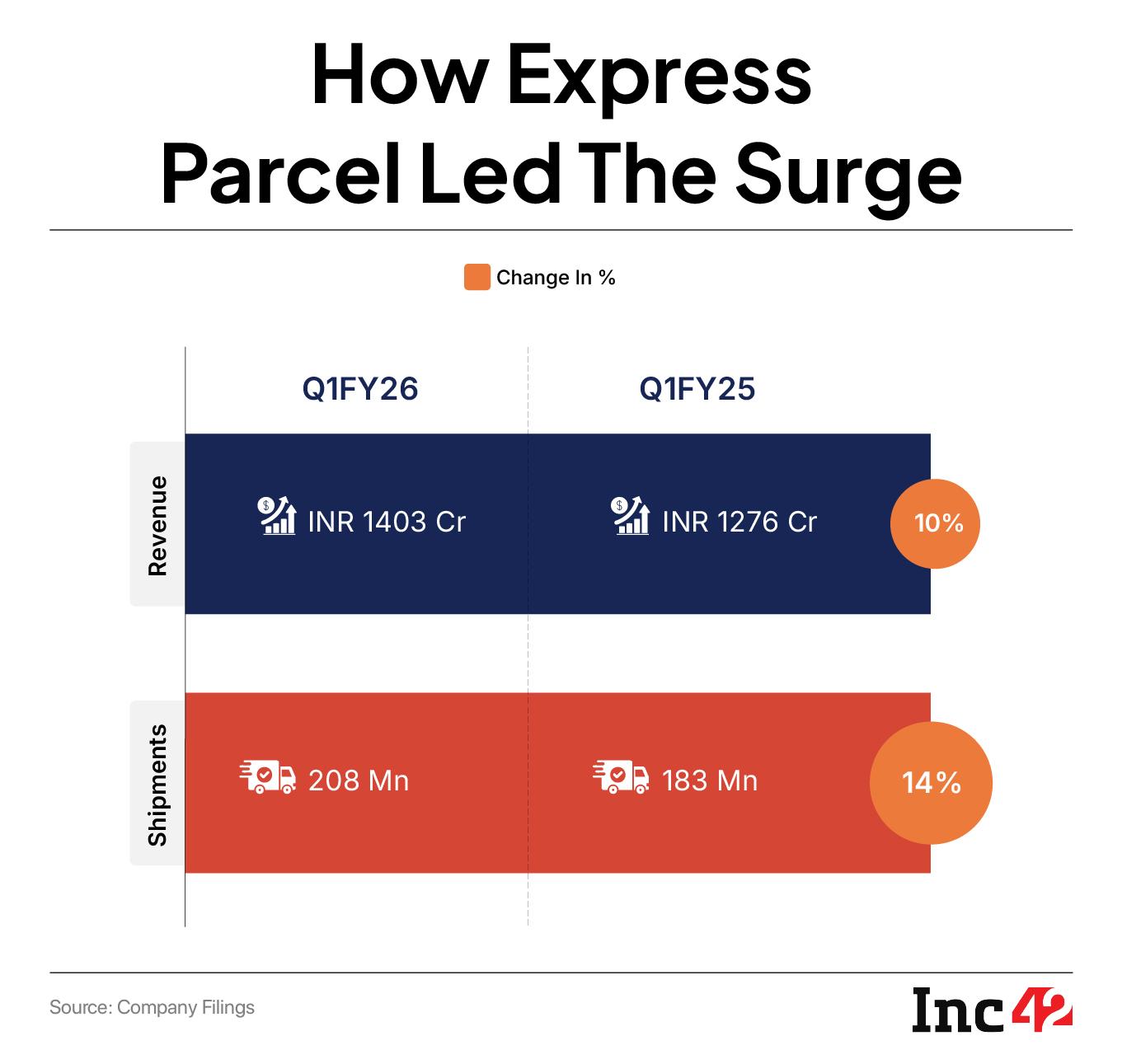

The biggest slice of the growth pie came from Delhivery’s express parcel business. In Q1 of FY26, the company handled 208 Mn shipments, up 13.6% over the last year and a striking 17% higher than the previous quarter.

This growth was not simply a reflection of an expanding ecommerce market, which has been growing at a steady 12–15% annually for the past three years. Instead, it was the result of deliberate targeting of high-growth customer segments.

The company saw shipments from small and medium businesses shoot up beyond 37% over the last year, led by the Delhivery One platform. The direct-to-consumer brands too chipped in, with volumes beating last year’s by 25%.

While express parcels grabbed the headlines, the company’s partial truckload (PTL) business quietly slid into the growth pie as its second biggest piece. The PTL segment grew 17% on-year, delivering INR 508 Cr to the revenue pie. Sequentially, the growth remained flat at 2% but, given that Q1 is seasonally soft compared to the high volumes of Q4, holding steady was itself an achievement.

PTL handled 458,000 tonnes of freight in the quarter, nearly 15% more than the same period a year back. “As we continue to expand into under-served geographies and into SME and retail segments of the market, we expect more than 20% annual growth rate in overall tonnage to continue in the immediate future,” the company said in its letter to shareholders.

The turnaround in PTL profitability has also been significant, with service EBITDA margins improving from -43% in Q1 of FY23 to 11% in Q1 of FY26. The management looks at a 16–18% margin growth over the next two years, aided by higher volumes, better utilisation of gateways and trucking assets, and more automation in freight handling, it said in the letter.

While the first quarter result screams of Delhivery’s sustained profitability, it also hints at a quiet pivot to placing calculated bets on ultra-fast and hyperlocal delivery segments.

The trigger for this shift is the rise of quick commerce. Led by players like Blinkit, Zepto, and Swiggy Instamart, quick commerce in India has widened beyond groceries to cover packaged foods, beauty and personal care (BPC) products, and even electronic gadgets, with its operations heavily skewed on metro cities.

On the surface, it may not seem like a natural fit for Delhivery, which specialises in large-scale intercity transport.

But, as the company noted in its letter to shareholders, quick commerce has created an immediate opportunity for its PTL division. Delivery spotted the opportunity in the supply chain behind the 10-minute delivery format – moving goods between central warehouses and the network of urban dark stores. Delhivery has begun serving brands selling on these platforms with its experience in scheduled B2B freight to a high-velocity retail channel.

The management, however, is realistic about the limits of quick commerce. The model, they point out, is geographically narrow and category-specific. An overwhelming majority of India’s ecommerce volumes still come from Tier III–IV cities and from low-velocity, long-tail categories like apparel, accessories, and home goods.

It means that quick commerce may remain a specialised adjunct to the broader ecommerce market, rather than coming up as a replacement. But for Delhivery, the link to PTL offers immediate, profitable growth without distorting the economics of its core network, according to them.

Where Delhivery’s ambitions surpass quick commerce are its Rapid and Delhivery Direct initiatives. The two services are designed to give it a stake in both hyperlocal and ultra-fast delivery markets, and to extend its value proposition to entirely new customer bases.

Rapid, launched as a network of dark stores, is built for below-1-to-3-hour fulfilment for direct-to-consumer (D2C) brands. As of Q1 of FY26, Delhivery operates 20 Rapid locations across three cities and plans to take the count to 35–40 by the end of the fiscal. Rapid is focussed on consumer-facing ecommerce, providing inventory storage and fulfilment for D2C players that want to compete on speed.

The company, however, looks at B2B applications. “This base network of dark stores and in-city delivery will allow us to build Rapid B2B fulfilment for time-sensitive categories such as automotive spare parts, electronic spares, tyres, critical industrial components, lubricants, specialty chemicals and certain FMCG products,” the company said.

The potential here is not just incremental revenue, although the management estimates that Rapid could reach INR 80–100 Cr over time, creating an operational presence that Delhivery can use for multiple customer segments.

Delhivery Direct, on the other hand, makes a greater push to the over $10 Bn market for on-demand intra-city logistics for SMEs and consumers. In Q1 of FY26, it was rolled out in Ahmedabad, Delhi NCR, and Bengaluru.

Unlike Rapid, which relies on a network of dark stores, Direct is built around a flexible fleet capacity and a digital booking layer, which makes it more akin to what same-day-delivery players like Porter or Blowhorn offer, but with the added advantage of being part of Delhivery’s national network.

The management calls Delhivery Direct “a sizeable future opportunity” and is prepared to invest accordingly. The letter to shareholders makes it clear that the company will step up investment, especially in case of Delhivery Direct, as the service is expanded across India, and will focus on building up fleet capacity in step with investments in demand generation.

The capital commitment is not trivial. The company had pumped INR 14 Cr in Q1 alone into both Direct and Rapid, but emphasised that no material balance sheet investments (capex and working capital) were required for these services.

Besides organic growth, Delhivery is also repeating from the inorganic route in a big way. The logistics major recently made its largest acquisition yet by picking up competitor Ecom Express in an INR 1,369 Cr deal. The move instantly reshaped the market.

Ecom Express Expands The ReachDelhivery CEO Sahil Barua told investors during the Q1 of FY26 earnings call that with Ecom Express, “about 50% of our size” and now part of the fold, Delhivery’s overall market share has grown by roughly 25% or more.

But the real surprise came in customer retention. Delhivery had anticipated keeping around 30% of Ecom Express’s shipment volumes after acquisition, but it held on to 50–55%. This stickiness has given the integration an early boost. Ecom’s wider pin code reach is another major win for Delhivery and it is likely to widen the coverage from 18,857 pin codes in Q1 FY26 to about 19,200 in the coming quarter. In logistics, that extra reach translates directly into denser routes, better truck utilisation, and lower costs per delivery.

Delhivery, however, isn’t simply absorbing Ecom’s entire footprint. Out of Ecom’s facilities, only seven – a mix of fulfilment and transport hubs – will be retained long-term under a network rationalisation plan aimed at avoiding duplication and maximising efficiency.

This kind of operational discipline has helped Delhivery pull off profit through five straight quarters, including a 67% jump in net to INR 91.1 Cr in Q1 of FY26.

The acquisition had little impact on the Q1 financials since the deal was closed on July 18 and only a small rise in volume was visible around end-June. “But July volumes are running notably higher,” Barua pointed out, with the full effect expected in the Q2 numbers. “The integration will cost about INR 300 Cr over Q2 and Q3.”

The integration cost would comprise the cost of rationalising the network footprint and overhead costs. “We expect that almost all of these costs would be concentrated in a six-month period from the date of acquisition.”

Ecom Express adds more than volume to Delhivery’s core express parcel and PTL business. Its local hubs and last-mile fleet give Delhivery the option to scale Rapid, its below-3-hour fulfilment service, and Delhivery Direct, its on-demand intra-city offering. It also boosts quick commerce replenishment by linking feeder cities to urban dark stores.

By combining Ecom’s local reach with its own national scale, Delhivery now spans the full range of logistics – from multi-day intercity freight to sub-hour urban drops – a breadth a few rivals can match.

[Edited by Kumar Chatterjee]

The post Not Just Parcels, Delhivery Delivers Profits, 5 Quarters And Counting appeared first on Inc42 Media.

You may also like

Benefit of lakhs or loss of thousands? This game of 'No Claim Bonus' is hidden in the Health Insurance portability

EastEnders fans 'rumble what Zoe Slater is really hiding' after Joel bombshell

'Always ready to serve': Saudi student stabbed to death in UK was a Kaaba volunteer

Table tennis: Team competition in 2026 World Championships expands to 64 teams per gender

MHA calls on Bengal LoP Adhikari to enquire about attack on his convoy