Just as we were about to finalise this edition of Inc42 Markets, word broke out about a ceasefire and potential peace talks in the future between India and Pakistan after two weeks of high tension and nervousness among citizens of both countries. This has naturally sent the Indian stock markets and new-age tech stocks into a bit of a lull and potentially bearish situation.

To be clear: tensions are still high and there were reports of later in the evening even after a ceasefire was officially confirmed.

Obviously, from a business point of view, there’s no time like peace and stability for growth. But this past week has all been about drones, rumours, speculation and fear — so naturally, even the markets did react accordingly.

War is not great for business and the economy and has a decades-long impact, and it’s safe to say that everyone is now breathing a sigh of relief after the ceasefire, even as many acknowledge that we were pretty close to something quite bad. And the end is certainly not near.

Questions From The Public MarketsIf you have invested in the public markets, it’s natural to have questions about what this means for your portfolio. For founders and business owners looking to take their companies to the IPO milestone, this is yet another complication — no doubt, many boardrooms have spent the past two weeks debating whether to delay potential steps towards an IPO.

“Retail investors are the most vulnerable class, and these kinds of events disrupt their sentiment. Plus, war is detrimental to any economy. If we look at it from a historical point of view, India has previously done well post such events and the market recovered, but that doesn’t mean investors will be carefree,” says Bhavya Shah, head of research, at Wallfort PMS.

Shah added that some IPOs might also get impacted a bit as they draw fresh money and investors will be careful, but good companies will sail through this. For example, the Ather Energy IPO struggled to get subscriptions, but the IPO sailed through eventually.

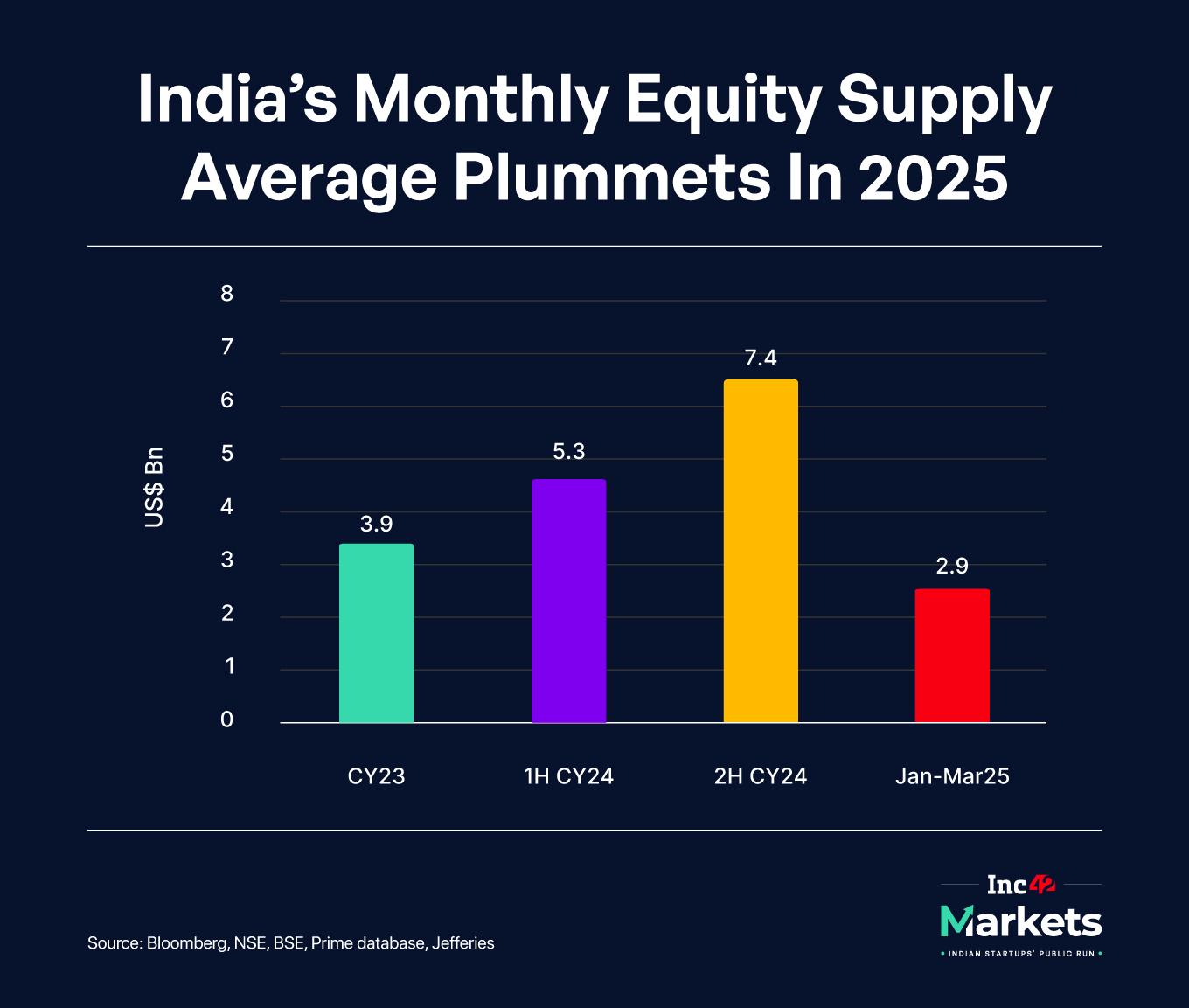

Brokerage Jefferies said equity supply by way of IPOs can be calibrated well, but in 2024, nearly 75% of the supply was in the form of QIPs, PE block deals and promoter-led block deals which can spring up on short notice. A potential escalation in the India-Pakistan border tensions may weigh on market returns further and have a cascading effect on future equity supply.

This year has already seen a drop in the monthly average of equity supply, as per the brokerage.

However, it was a rough experience for newly-listed Ather with the stock plummeting soon after listing and falling more than 10% in its first week of trading. This was expected to some extent, given the weak outlook on EV startups as a whole in the market, but many attribute it to the market sentiment as well.

The Growth Story Takes A HaltPrashanth Tapse, senior VP, research analyst at Mehta Equities, said, “The market was expecting this kind of tension escalation between India and Pakistan. If it escalates further for more than 15-20 days, that would be the biggest concern for the market as well as the sentiment of India. A few sectors like tourism, hotels, and airlines, will have the biggest impact on an immediate basis.”

Tapse spoke to Inc42 before the ceasefire, but added that the next quarter or so will be very crucial. ”The next three months will be very crucial for these sectors, even if this settles down in a week or two.”

Given the disruption to air travel in the past few days, ecommerce and logistics startups have had to scale back operations in a major way. “Recent developments near the international border have resulted in movement restrictions affecting several districts Jammu & Kashmir, Punjab, Rajasthan, Haryana, and the Chandigarh Tri-City,” Delhivery said on May 9, adding that services in these states could be disrupted due to the conflict.

The ceasefire is likely to calm some of the panic, but many analysts claim that this flare-up is not good for the economy, especially at this time when the US is looking to extract leverage.

Tapse and Shah both believe that global rating agencies have downgraded the Indian GDP growth forecast amid the Indo-Pak issue. And now with chances of peace talks in the near future, this might get revised but by how much is the question.

Of course, this does not change the long-term outlook for India as an investment destination. “However, the long-term growth story for the Indian market and economy remains intact. Only Q1 will see some adverse impacts. Defence-related stocks and companies in drones and aerospace, as well as cybersecurity, will benefit from the situation,” Tapse added.

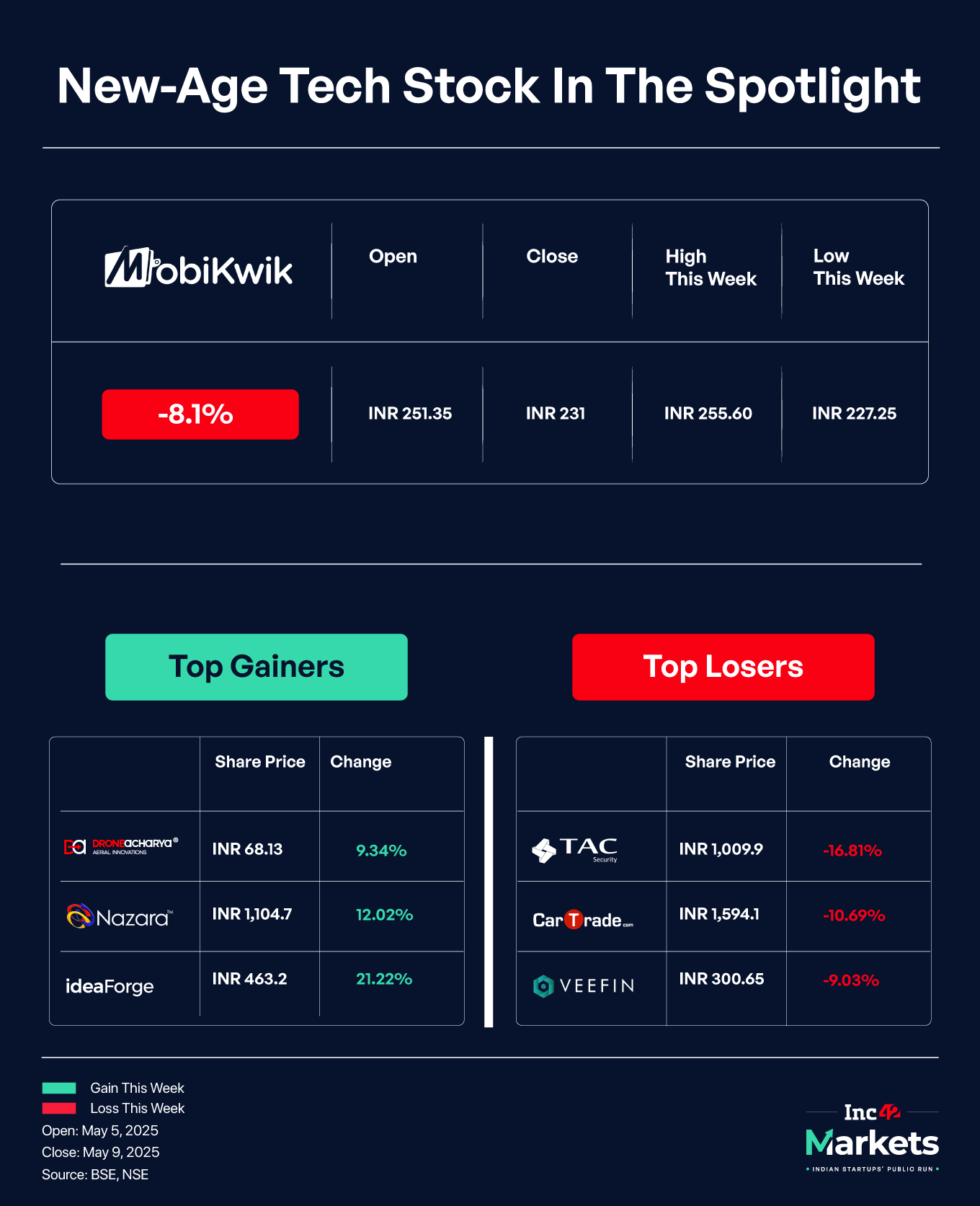

Incidentally, ideaForge and Droneacharya were among the highest gainers in the new-age tech stock cohort as we have shown below. Upcoming listings in this sector will be keenly watched for the potential upside in defence tech.

As for foreign investors, who have always had an outsized influence on the Indian market, foreign institutions have once again started showing interest in investing in the Indian market. Tapse says there could be two possible reasons for this. “First, there is no alternative for FII money to be in a safer market, and the expected India-US trade deal, from which India is likely to benefit more than China.”

A Rebound After The Ceasefire?Shah added that geopolitically, India stands to benefit in the long run. Even as things have taken a bit of a pause due to the tension between India and Pakistan, we will see a shift as the war subsides.

Of course, with or without the Indo-Pak war, volatility will remain as India is one of the major growing economies in the world, and any geopolitical issues will have some impact on the market. The issue of US tariffs, for instance, caused a minor kerfuffle among public markets in India too.

A Jefferies report this week said FPI inflows to India had started to turn positive from the end of March, and investors in both the EU and the US are shifting from an underweight on India to neutral and some even going overweight.

FPIs see the weak earnings growth of Indian companies as a potential hurdle. For FY26, many earnings guidance are already cutting estimates by up to 2%. Slowing government spending on infrastructure, welfare tilt at states, consumption slowdown, state of the housing cycle, non-financial factors, as well as a slowdown in domestic flows.

Jefferies noted that the tense situation on the border between India and Pakistan is a potential negative for travel and tourism, high beta stocks and industrials in particular, and the brokerage cut the weight of the tourism and real estate sector in its model portfolio.

Even as they espouse caution among investors, analysts are clear that even the ups and downs of the market due to war-like situations move in a cycle. After a point, everything balances out and then once again, there’s a focus on fundamentals.

In the present situation, Indian new-age tech stocks need to stand out in terms of revenue growth and profits, as it outweighs any macroeconomic or geopolitical factor to a large extent, and on this front, we have not seen big leaps compared to FY24.

MobiKwik’s Bad Time ContinuesThis fintech stock is down 63% since late December. MobiKwik’s slide soon after listing is one that has largely gone under the radar, given the volume of listed tech companies in India today, but this is a run that’s more or less mirroring Paytm’s bad run.

Now, Paytm has said that it would scale back from personal loans and the super app model and focus on payments and wallet for growth, along with merchant services. On the other hand, MobiKwik has no strong verticals to hang its growth story on.

Thus far, MobiKwik has not announced the dates for its FY25 annual results and the Q4 numbers. These will give us the clearest idea of what is working. In the past few months, however, MobiKwik has taken the super app model seriously. Will this pay off?

- FirstCry subsidiary GlobalBees has seen the departure of three directors – Harsha Deepak Kumar (of Lightspeed India Partners), Sudhir Kumar Sethi (of Chiratae Ventures) and Kaveesh Chawla (of Premji Invest) — from its board in quick succession

- The parent company of Policybazaar has said that its healthcare venture PB Healthcare secured INR 1,843 Cr as a part of its seed round led by General Catalyst

- : The delivery giant’s losses ballooned to INR 1,081 Cr. nearly doubling from last year, as the investments in Instamart continue to eat into the bottomline

- Despite being weighed down by a fat net loss of INR 544.6 Cr in Q4 FY25, Paytm has made a healthy stride towards its goal of turning profitable in FY26. Here’s how the company plans to get there

- Geotech company MapmyIndia posted a consolidated net profit of INR 49 Cr in the fourth quarter of FY25, marking a near 28% jump

- Dronetech company reported its third consecutive loss-making quarter in FY25 posting arrears of INR 25.7 Cr in Q4 FY25

The post appeared first on .

You may also like

"People here trust army, there is no panic," say locals in Amritsar

India-Pakistan ceasefire: Asaduddin Owaisi raises questions

Arne Slot shares true feelings on Mikel Arteta after Arsenal boss comes under criticism

Wycombe Wanderers boss eyes play-off glory after nightmare gift to rivals Wrexham

Tragic Loss: Indian Armed Forces Personnel Killed Amid Escalating Tensions with Pakistan