Troubles seem to be far from over for Tata Digital-run BigBasket.

Once the poster child of India’s online grocery delivery finds itself entangled in deepening losses, shrinking revenues and sustained churn in user base amid raging murmurs of a corner office crisis.

The company was seen as a crown jewel when Tata Sons acquired a majority stake in BigBasket in 2021, betting on grocery as its anchor in the digital ecosystem. Grocery has always been a high-frequency category central to Indian households and BigBasket, then the market leader, seemed to be the perfect bet for the Tatas.

Four years on, the scenario looks entirely different. For FY25, BigBasket’s parent Supermarket Grocery Supplies Pvt Ltd reported a staggering 42% increase in net loss to INR 2,006.8 Cr, with revenues dipping 2% to INR 9,866.7 Cr.

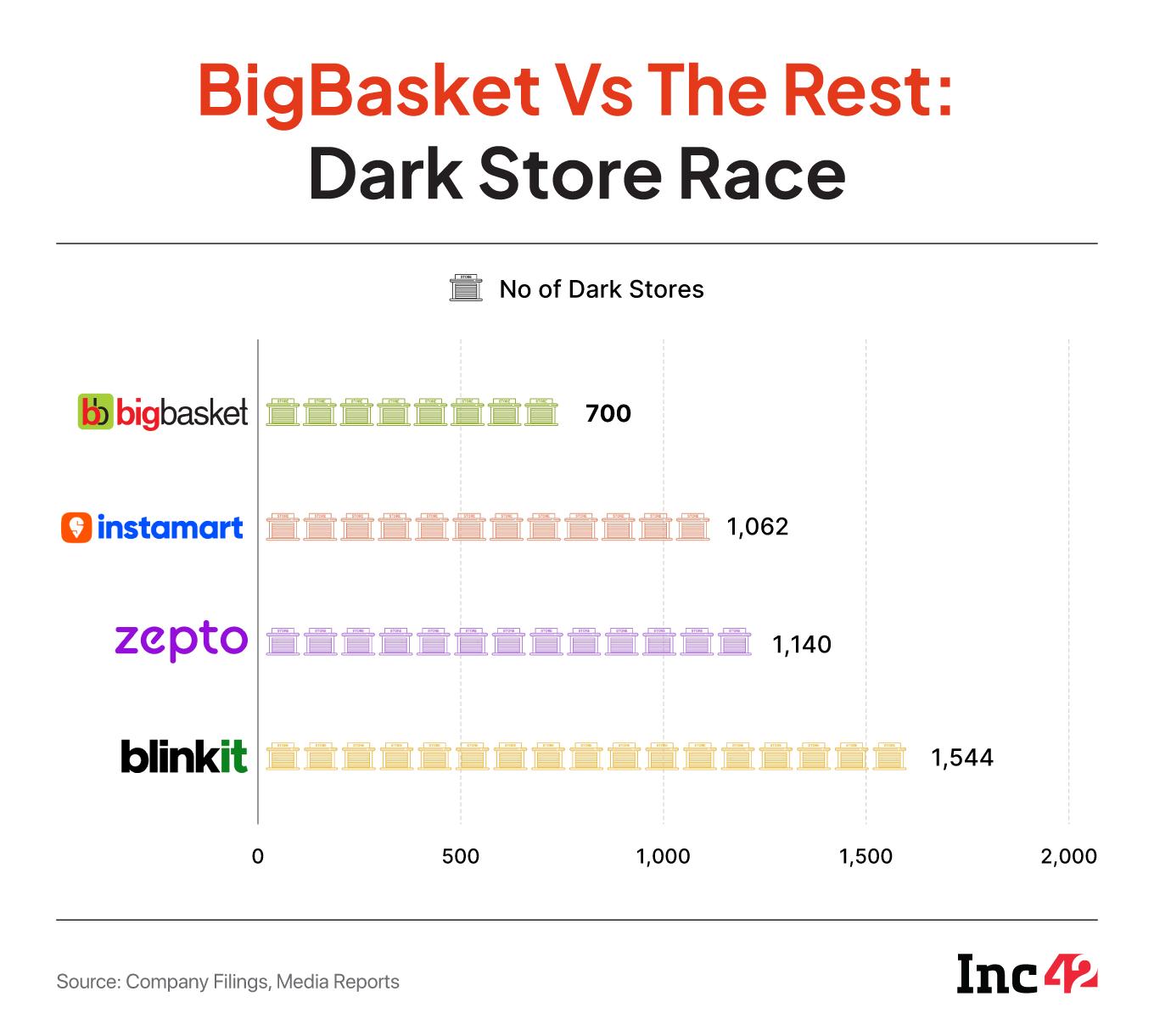

Industry analysts blame it on the dark store economics of quick commerce. Managing dark stores for delivery often weighs too heavily on the coffers of a company because of high fixed costs that may include rent, salary liabilities and inventory management, with expensive last-mile delivery and heavy customer discounts, although a dark store typically caters to a relatively small geography.

Until order density increases, the average order value grows and margins improve, each order costs more than what it fetches for the company. While the quick commerce plunge in 2022 kept building pressure on the margins, it didn’t balance it with a substantial increase in demand because of fewer customer additions. This only widened the fiscal gap.

To bridge this gap, BigBasket expanded from groceries to iPhones and gadgets, sometimes undercutting Amazon and Flipkart, but industry experts believe this only increased the losses without creating stickiness.

The flight of users increased when its value-driven, dependable online grocery heritage was watered down in the heat of agile quick commerce players like Blinkit and Swiggy Instamart, and under pressure from rooted ecosystem companies such as Amazon.

No wonder, investors began shying away. Even holding company Tata Digital was found digging its heels in when it came to doubling down on investments in BigBasket, leaving external investors more sceptical. “If the group itself isn’t fully committed, why would outsiders take the risk?” reasoned a venture capital partner, refusing to be identified.

Balance Sheet Remains A Pain PointBigBasket’s biggest challenge in the basket of woes is its balance sheet.

The company could never make profit, but the distance between its ambition and financial reality expanded sharply in FY25.

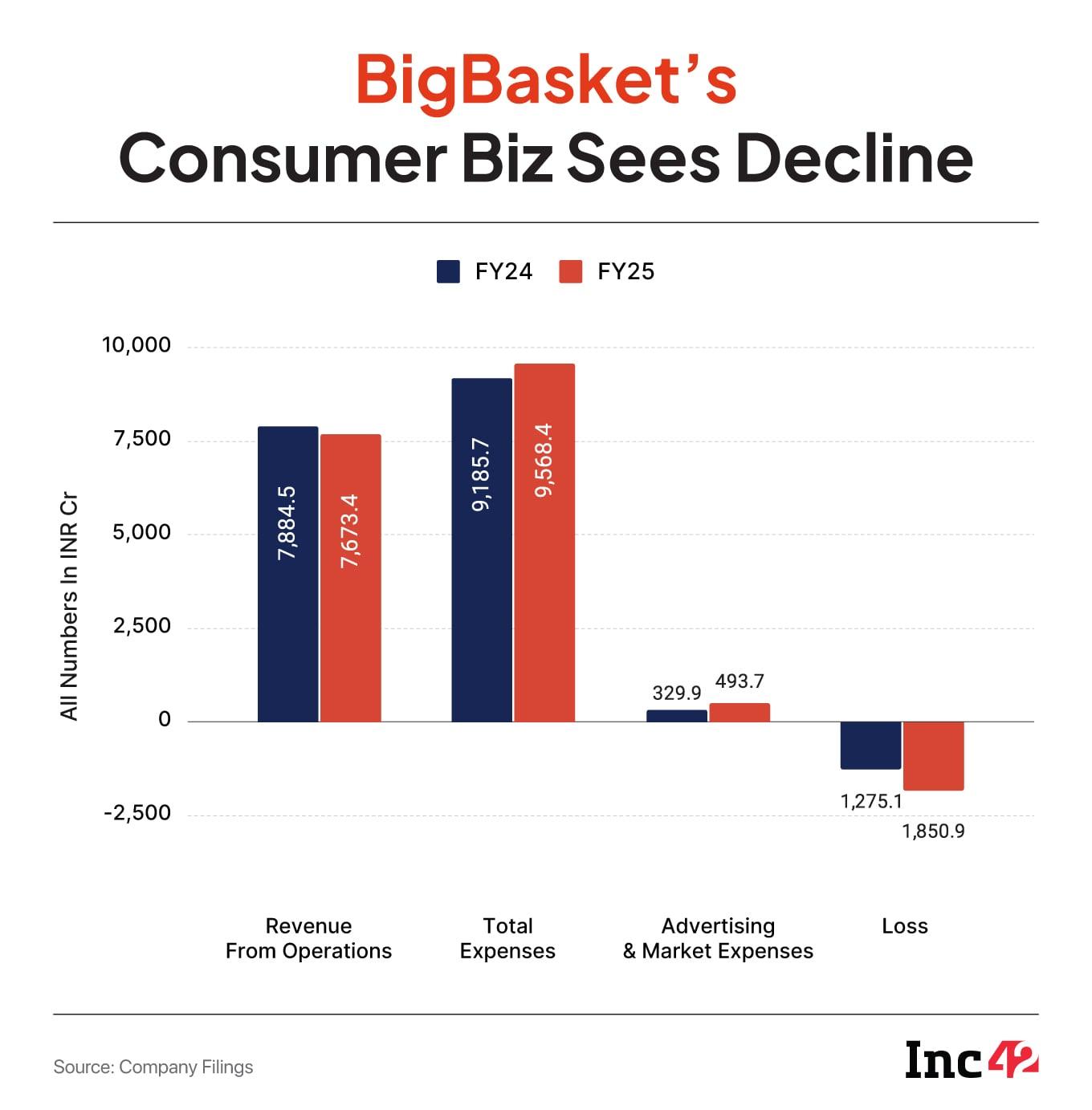

Parent firm Supermarket Grocery Supplies Pvt Ltd saw its net loss increase 42% to INR 2,006.8 Cr from INR 1,415.2 Cr in FY24, while operating revenue slipped 2% to INR 9,866.7 Cr. Its B2C arm, Innovative Retail Concepts, declined 3% in revenue and skidded 47% deeper into the red. The advertising revenue, once seen as a lever for higher-margin growth, slumped almost 20% to INR 203.5 Cr.

“BigBasket was never profitable, but the 42% rise in losses in FY25 was directly linked to their switch to quick commerce. The investment is showing up in their P&L without a corresponding lift in revenues,” pointed out Satish Meena, founder of Datum Intelligence.

Unlike Zepto or Blinkit, which are raising and deploying fresh capital to build scale, BigBasket turned cash-strapped. Under Tata Digital, the focus has been on consolidation, rather than aggressive investment. It left the company vulnerable in a capital-intensive, fast-moving market.

BigBasket merged its scheduled delivery and express units into a single proposition last year, promising delivery in 15–30 minutes. But, this strategic pivot disrupted its core value proposition. BigBasket’s original customers were hooked to the bulk purchase schemes, price competitiveness, and reliable next-day deliveries. There was a sudden spike in prices after the merger because the company could not continue to offer the discounts they were giving to protect unit economics.

This didn’t strike the right chord with the existing customers. “The consumer who was paying INR 340 for a 5 kg bag of Sona Masuri rice was suddenly asked to pay INR 373 or 380. The consumer didn’t care about the 30-minute delivery. Given a choice, they’d rather save money and get the order the next morning,” Sachin Taparia, founder of LocalCircle, said.

BigBasket began losing its loyal households. “For a commerce customer, the first priority is convenience, then cost saving. On both counts, others are doing better than BigBasket,” Meena said.

The sustained financial pressure and strategic missteps fostered rumours of a leadership churn in BigBasket.

Reports came out earlier this month suggesting that the company’s cofounders were in talks with Tata Digital to step back from daily operations and move to mentorship roles. In fact, speculation went rife that the search for a chief executive was in progress as CEO and cofounder Hari Menon’s five-year tenure under Tata’s ownership was about to end.

Menon, however, quickly ended the rumour. “Contrary to some media reports, there are no plans to hire a new CEO for BigBasket, and no formal search process has been initiated for such a role. We are fully focused on maintaining stability, innovation, and growth in the business,” he wrote on LinkedIn.

The statement may have stubbed out the speculation, but such debates stoke the perception that the company is under scrutiny. Insiders also affirmed that the Tata Digital and BigBasket managements are not often on the same page on strategy.

Parent Tata Digital was reportedly one of the three unlisted businesses of the Tata Group, besides Air India and Tata Electronics, to contribute nearly INR 180,000 Cr to the group’s INR 15,30,000 Cr topline in FY25, but with a combined loss of INR 15,500 Cr.

A slowing growth dragged Tata Digital down 14% to INR 32,188 Cr in terms of consolidated operating revenue in FY25 from INR 37,355 Cr a year back. With a portfolio of BigBasket, Croma, Tata Neu, Tata Cliq, 1mg, and Tata Payments, the group has had to manage several underperforming investments at the same time.

Tata Digital has so far avoided making large investments in BigBasket, choosing fiscal discipline over aggressive ramp-up. As BigBasket failed to match steps with its more rivals who could access large funding resources, Tata Group earlier this year reportedly geared up to raise $1 Bn from external investors, but the process has been hanging fire since then.

There are several reasons for the investor scepticism, according to analysts. “Tata Group’s majority ownership means that the strategic control ultimately lies with the parent, limiting the power late stage investors might have. Then there’s BigBasket’s loss of competitive edge. While Zepto is growing quickly and Blinkit benefits from Zomato’s distribution, BigBasket seems to be standing still – revenues are shrinking and customer growth is slowing,” Meena said.

Quick commerce requires significant and ongoing investment in infrastructure, logistics, and discounts. Without a clear guarantee of continued funding, few external investors would like to risk their money.

The presence of the Tata Group at the core of BigBasket is paradoxical. Tata Digital’s leash on BigBasket stops it from overspending like its VC-backed competitors Blinkit and Zepto that are investing billions in infrastructure, store expansion, and discounts to attract customers. BigBasket, in contrast, has to follow stricter financial rules that ensure stability and credibility that many new companies lack.

“BigBasket was the only thing that worked within the Tata Group’s ecommerce portfolio. They need to leverage it more and increase their output,” suggested an executive working for a rival quick commerce startup.

Tata Digital’s consolidated operating revenue declined 13.8% to INR 32,188 Cr in FY25 from INR 37,355 a year back, but net loss improved about 31% to INR 828 Cr from INR 1,201 Cr. Its online pharmacy 1mg posted a 20% rise in FY25 revenue to INR 2,392 Cr, while fashion platform Tata Cliq also saw its turnover rise 19% to INR 294 Cr.

The restraint has built a strong foundation. After a decade of ups and downs, BigBasket still has a strong brand presence in urban India. Customers still trust its reliable supply chain. Its private labels, daily subscription service BB Daily, and B2B segment supplying hotels, restaurants, and caterers still reflect loyalty and drive revenues. If these areas are scaled and integrated properly, they could give BigBasket an advantage with a diverse revenue model, especially since most competitors rely heavily on quick delivery.

But the situation is far from being hopeless. India’s$10 Bn+ quick commerce market with more than 30 Mn monthly users has emerged as the fastest-growing retail format in the country, growing 150% on-year in the first five months of 2025.

A rising middle class, estimated to be 1 Bn in strength by the time India turns 100 in 2047, with an annual income of INR 5 Lakh to INR 30 Lakh, in a $4.3 Tn consumer economy, is driving the surge in the ultra-fast delivery. Although the 10-15-minute delivery format has clicked in a big way, Indian households still shop a full basket for weekly or monthly supplementary purchases, besides impulse buying.

BigBasket, however, cannot afford a strategic shift now. The merger of its core grocery business with BB Now confused customers about its value, driving price-sensitive customers away. Competitors like Amazon Fresh and Reliance’s JioMart quickly became appealing options for those who did not want to exchange lower prices for faster delivery.

For BigBasket, the road ahead calls for greater clarity in choices: should it return to its roots as a full-basket value player or focus more on quick commerce or shift to a hybrid model that uses Tata’s broader consumer brands from Titan to Tata Consumer Products to stand out?

Ultimately, the company’s future will depend not just on gaining customers or on unit economics, but also on whether Tata Digital and BigBasket’s leaders can agree on a clear, shared vision.

[Edited by Kumar Chatterjee]

The post BigBasket Goes Bland: Can Tata Digital Spice It Up? appeared first on Inc42 Media.

You may also like

'OG' is a brilliantly made underworld gangster film on par with Hollywood standards, says Chiranjeevi

"Irreparable loss for the organisation": Uttarakhand CM expresses grief on passing of BJP veteran Vijay Kumar Malhotra

Oppn panicking as we delivered what they only promised in Bihar: Chirag Paswan

China's Factory Activity Shrinks For A Sixth Straight Month In September, PMI Remains Below The 50 Cut-Off Level

UGC Issues Show-Cause Notices to 54 Private Universities for Non-Compliance